32+ calculating after tax cash flow

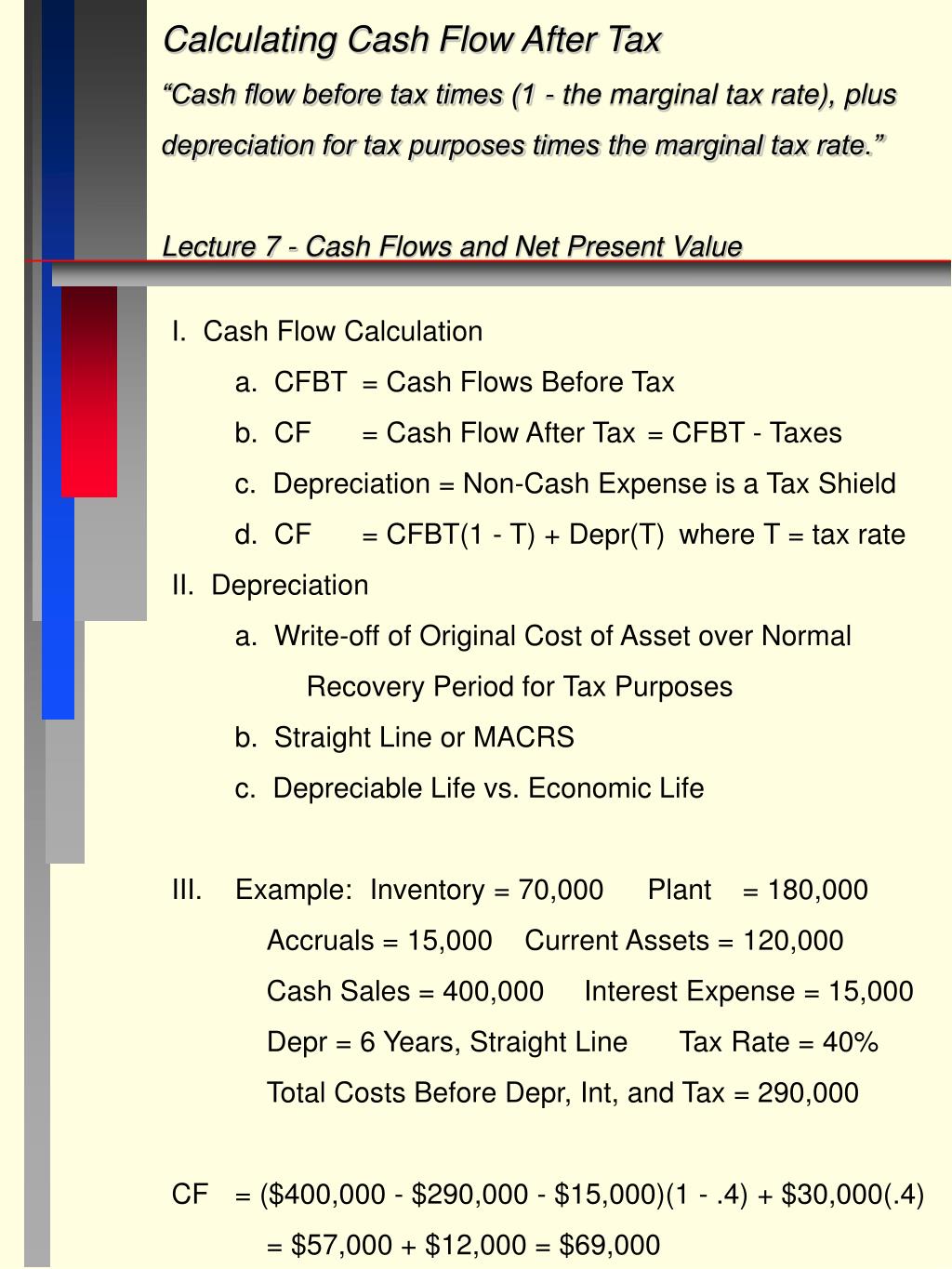

The formula will look like this. Web Lets say a financial analyst must calculate the cash flow after tax of a corporate project with operating income of 20 million dollars a depreciation charge of 3.

:max_bytes(150000):strip_icc()/GettyImages-1316069364-2ea8d9a797f2463f8a4d76ed90a95ffc.jpg)

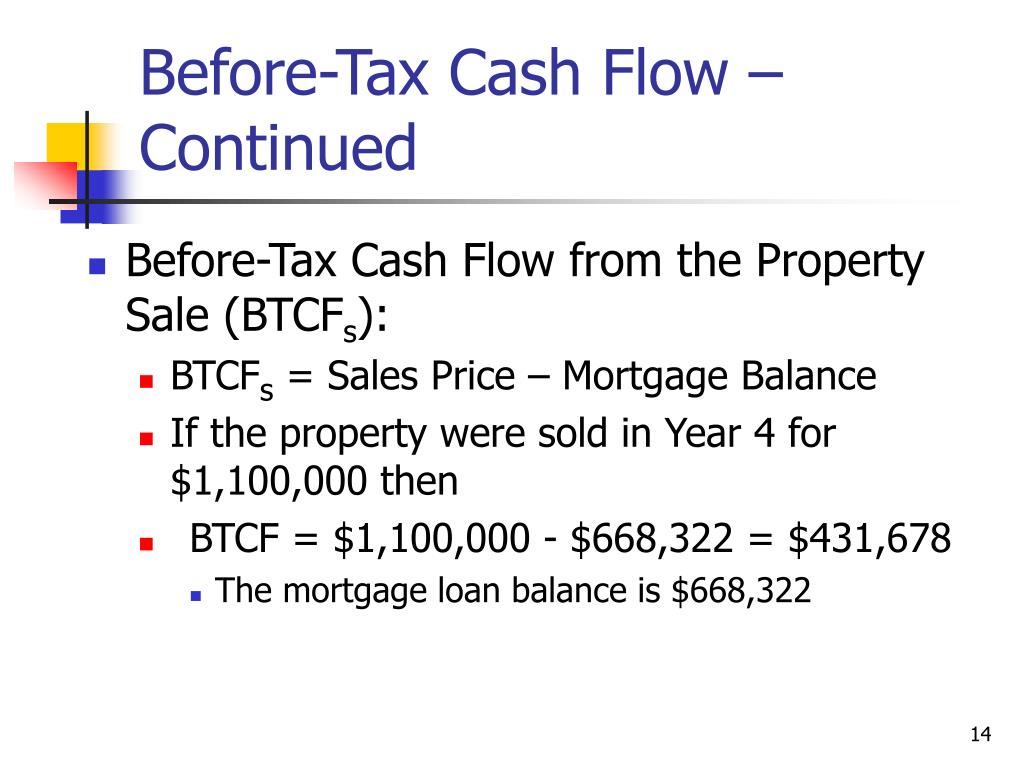

Calculate After Tax Cash Flow For Real Estate Investing

Web Cash after taxes Net income Depreciation Amortization Impairment charges.

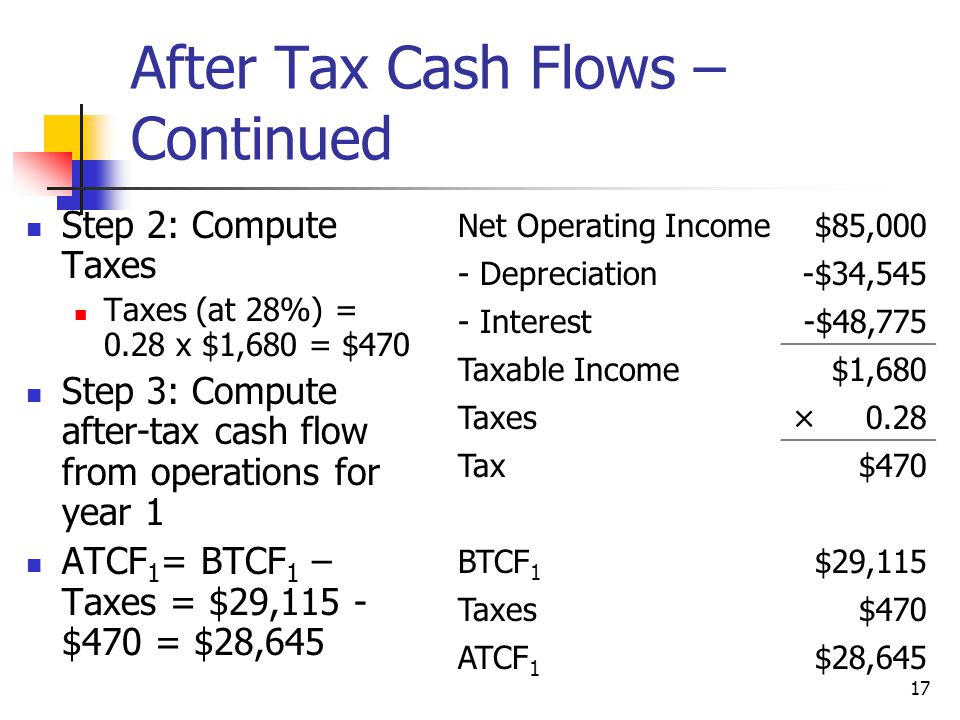

. Difference between deposits and withdrawals within a certain period of time. TI taxable income. Shows how to calculate cash flow after depreciation and.

The present value of after-tax cash flow can be. Web There are two different methods for calculating the cash flow. A business reports 10000 of.

Web How Does Cash Flow After Taxes CFAT Work. D t depreciation plus depletion EOY t. Get powerful streamlined insights into your companys finances.

NCFAT net cash flow after taxes. Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. Web Calculate the net after-tax cash flow effect of the following information using both the Indirect and direct methods.

Multiply your marginal tax bracket by the CFBT to see if you need to pay additional tax or. Web After Tax Operating Cash Flows - YouTube 000 319 After Tax Operating Cash Flows 1308 views Jul 15 2018 5 Dislike Share Save mike barth 204 subscribers In capital. 100 Accurate Calculations Guaranteed.

Expenses other than depreciation 80. The general formula for CFAT is. NCFAT NCFBT tax cash.

CFAT Net Income Depreciation Amortization. Web Once youve determined your net rental income and taxes owed you can easily calculate your after-tax cash flow. Web After-tax cash flow is one of the more useful cash flow measures because it considers the tax effect on profits.

Web Starting in year 3 you will receive 5 yearly payments on January 1 for 10000. Web To calculate your after-tax cash flow use the CFBT as the taxable income. You want to know the present value of that cash flow if your alternative expected rate of return is.

Example of Cash Flow After Taxes. Web NCFBT net cash flow before taxes. According to US tax law for the purpose.

Try Our Free And Simple Tax Refund Calculator. Web Compute cash flow after depreciation and tax. Ad Be the forecasting dynamo you were born to be with our free 13-Week Cash Flow Template.

Web After-Tax Cash flow 28 000 12 000 10 000 1 500 4 500 From a tax view point there are two types of investments.

Given The Following Information Please Calculate Chegg Com

Ppt Chapter 11 Powerpoint Presentation Free Download Id 3775998

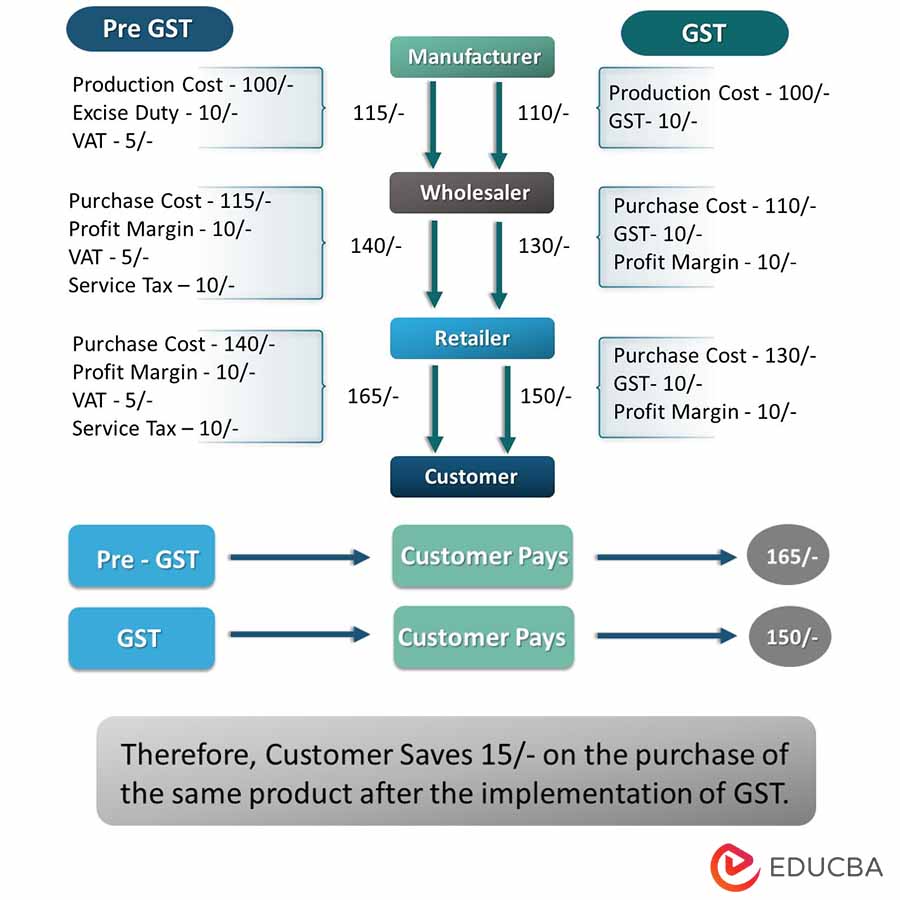

What Is Gst Types Rates Calculation Registration Examples

Solved 2 Year Table 2 A B S D E F After Tax Cash Deprecia Chegg Com

Income Tax Depreciation Cash Flows After Tax Youtube

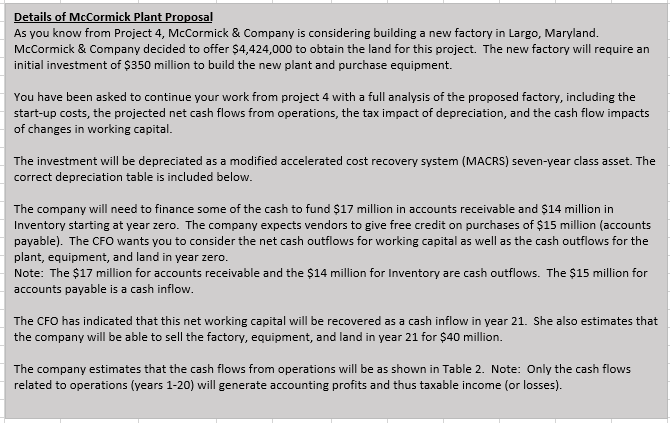

Solved Assume That It Is January 1 2019 And That The Chegg Com

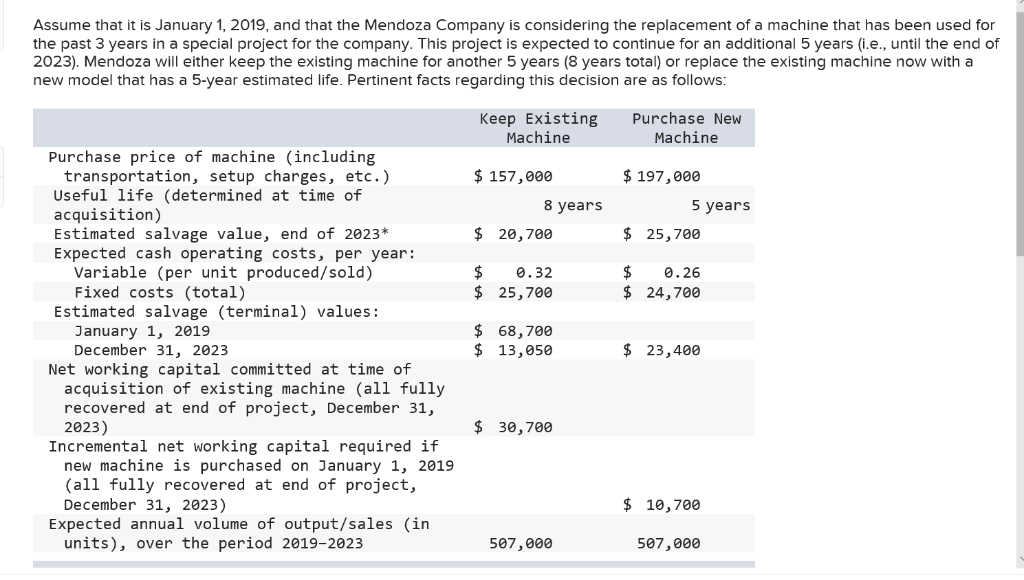

Ex 99 1

Ppt Chapter 11 Powerpoint Presentation Free Download Id 3775998

How To Build An After Tax Discounted Cash Flow Model From Scratch Using Excel Youtube

Altman S Z Score Corporate Bankruptcy Formula Overview Analysis Cfo Bridge

Investment Analysis And Taxation Of Income Properties Ppt Video Online Download

Acg3331 Chapter 16 Flashcards Quizlet

Cash Flow After Tax The Strategic Cfo

Ppt Calculating Cash Flow After Tax Cash Flow Before Tax Times 1 The Marginal Tax Rate Plus Powerpoint Presentation Id 6569647

Investment Analysis And Taxation Of Income Properties Ppt Video Online Download

How To Calculate After Tax Cash Flows Bizfluent

30 Best Business Accountants Bookkeepers In Richmond Melbourne 2023